what is doordash considered on taxes

Gross earnings from DoorDash will be listed on tax form 1099-NEC also just called a 1099 as nonemployee compensation. There isnt really a category of taxes for DoorDash but we know that a lot of Dashers refer to their tax responsibilities as DoorDash taxes so weve used that term now and again.

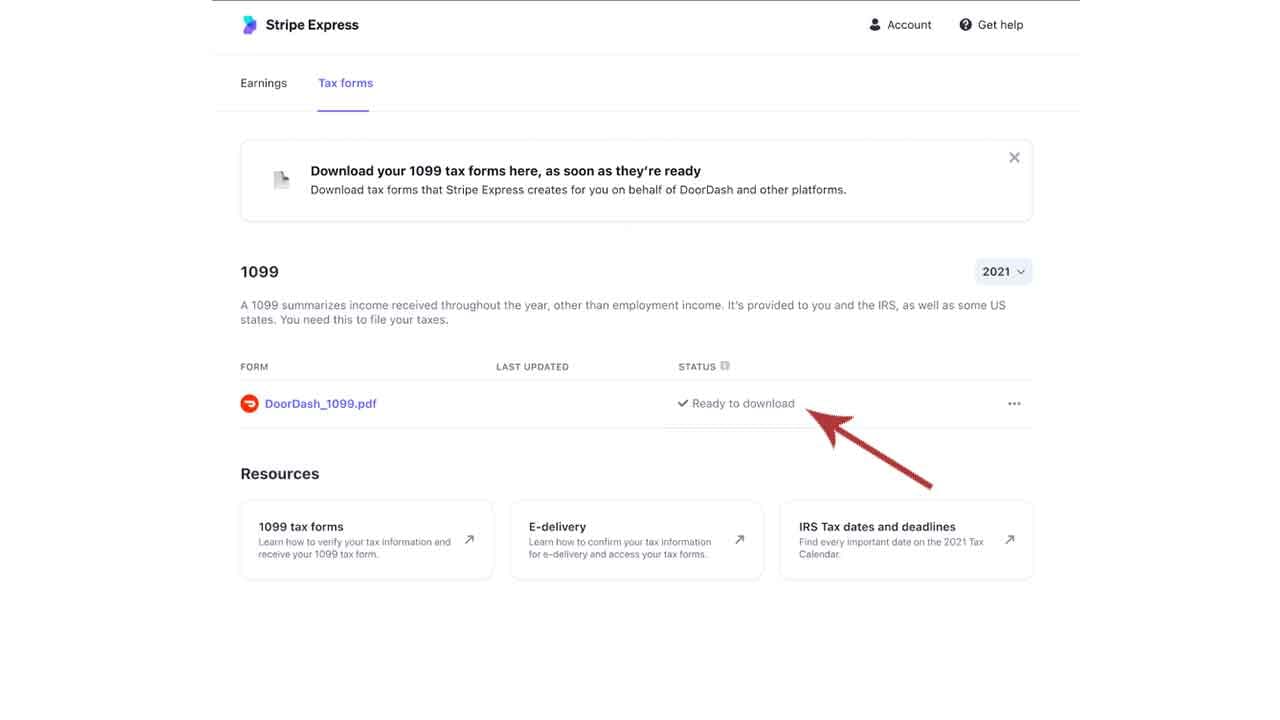

Complete Guide To 1099 Doordash Taxes In Plain English 2022

Its provided to you and the IRS as well as some US states if you earn 600 or more in.

. Do you pay taxes on Doordash tips. With this method you deduct a certain amount 0. Youll input this number into your Schedule C to report Gross Earnings on Line 1.

This is the reported income a Dasher will use to file. This is the part of Doordash taxes that can really throw people off. Self-Employment tax is not an extra tax for the self-employed.

Relying on the Doordash mileage stats estimate would have cost me more than 200 in additional taxes at the end of the year. You must report all income regardless of how little it is. The only tax form that eligible Dashers will receive is the 1099-NEC and this is ONLY for Dashers who earned 600 or more on the platform in 2021Dashers who earned less will.

DoorDash currently sends their. Please note that the amounts on the 1099-K are not going to be equal to the payments actually made to the Merchant by DoorDash. The first is your standard federal income tax.

Its just our version of employment taxes Social. Also on the Schedule C youll mark what expenses you want to claim as. That means the IRS considers you to be self-employed.

There is a 400 threshold for self-employment tax. We recommend you put aside 30-42 of the profit you earn from Doordash. It also includes your income tax.

You write off your expenses as part of determining taxable income as a Doordash contractor. This includes 153 in self-employment taxes for Social Security and Medicare. Since they are not adjusted for commissions refunds or any other adjustments.

FICA stands for Federal Income Insurance Contributions Act. The items above are not tax deductions but business expenses that we list on Schedule C. FICA taxes for dashers.

You will end up paying 153 in Self Employment Taxes and between 15-25 in Federal and State. I swear a burger fries and a. Remember that your taxes for Doordash are small business taxes.

Federal income taxes apply to Doordash tips unless their total amounts are below 20. Doing your own taxes. First understand that the typical DoorDash delivery person is an independent contractor.

Your tax bill is based on your profits or whats left over after expenses. DoorDash will not withhold any tax from. Let the team at HR Block walk you through how taxes work for DoorDash independent contractors.

You will simply need your 1099-NEC form which as stated earlier DoorDash will usually automatically send to you well in advance of tax filing time. Yes - Cash and non-cash tips are both taxed by the IRS. DoorDash doesnt withhold taxes so youll need to set.

Schedule SE states that if your total self-employment profits are less. Independent contractors for Doordash Uber Eats Grubhub Instacart and other gig companies can usually take 20 off their taxable. DoorDash drivers are self-employed rather than employees.

While online marketplaces like DoorDash have historically relied on marketplace sellers merchants to remit sales taxes new marketplace facilitator laws at the state level shift the obligation to a marketplace facilitator to collect and remit sales tax on behalf of sellers. A 1099-NEC form summarizes Dashers earnings as independent contractors in the US. These marketplace facilitator laws vary by state and in.

That said here are three basic things that help you understand how your Doordash earnings will impact your taxes alongside of course any other earnings from other gigs. Per IRS guidelines Gross Volume processed via the TPSO which in DoorDashs case is the Subtotal and Tax on orders processed. Expect to pay at least a 25 tax rate on your DoorDash income.

A peer-to-peer sale may be considered to be a. That makes it important to understand the DoorDash tax rules. Your FICA taxes cover Social Security and Medicare taxes 62 for Social Security and.

Doordash Driver Confronts CVS Manager For Reporting That She Did NOT Receive Her FoodThis type of crap happens all the time to drivers and these companie.

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Getting Started Doordash Integration

Trying To Pay Taxes For My 1099 Doordash Am I Doing This Right I Know It S 368 I Have To Pay R Tax

How To Become A Doordash Driver Dasher Pay What To Expect Review

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

Tips For Filing Doordash Taxes Silver Tax Group

15 Must Know Doordash Driver Tips 2022 Make More As A Dasher

Doordash Filing 1099 Taxes The Process Youtube

How Much Should I Save For Taxes Grubhub Doordash Uber Eats

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Is Dashpass Worth It We Run The Numbers And Find Out

How Much Should I Save For Taxes Grubhub Doordash Uber Eats

Getting Started Doordash Integration

Doordash How It Works Pricing How To Use And More 2022

Doordash 1099 Taxes And Write Offs Stride Blog

Doordash Driver Pay Per Hour Week Month Expenses More

How To Become A Doordash Driver Requirements Application Ridester Com